To calculate a loan in Excel, you can use the built-in financial functions. Here’s how you can do it step by step:

Gather Loan Information: You’ll need to know the loan amount, interest rate, loan term (in years), and any additional fees or payments associated with the loan.

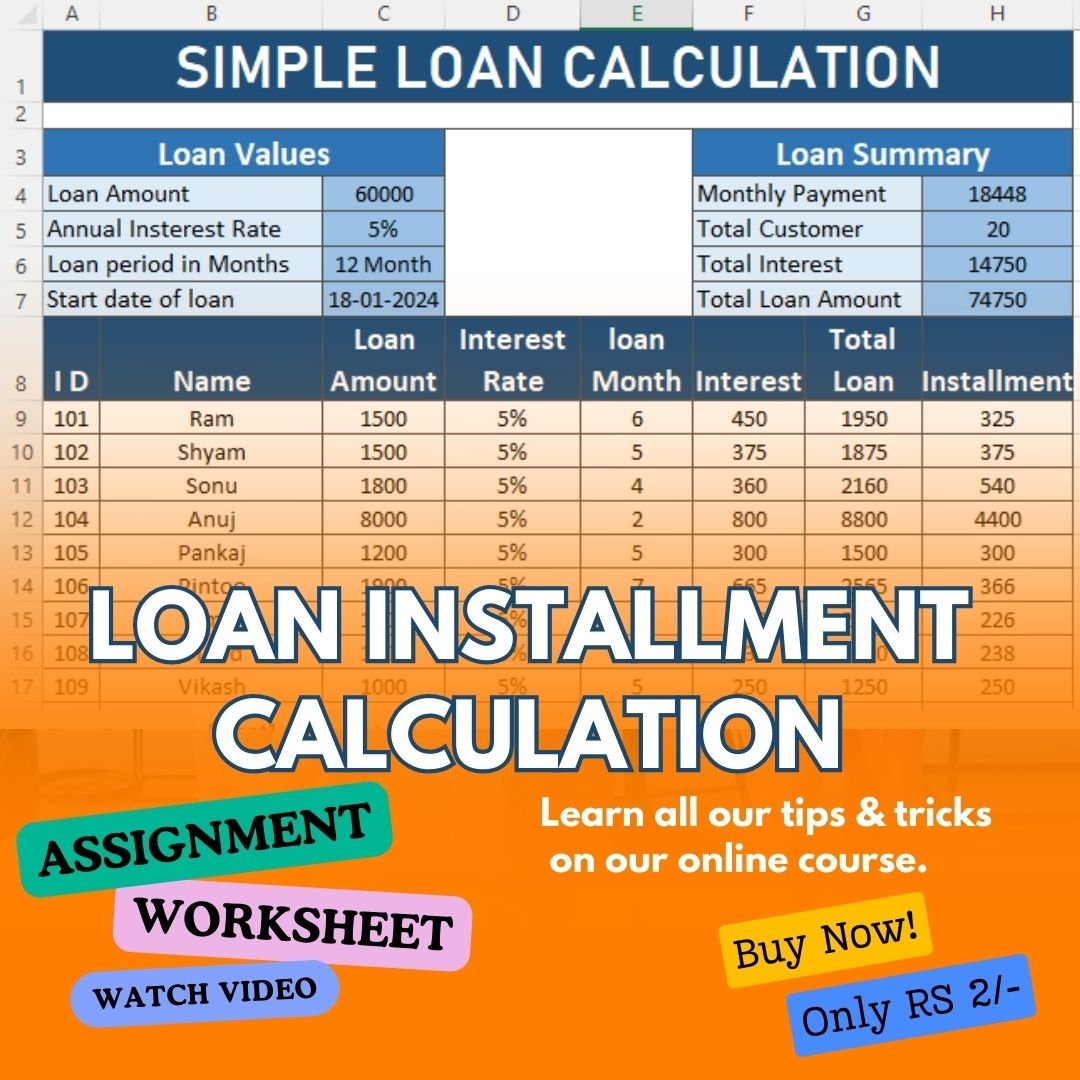

Set Up Your Excel Sheet:

Column A: Time period (usually months)

Column B: Loan payment

Column C: Interest paid

Column D: Principal paid

Column E: Remaining balance

Input Loan Information: In your Excel sheet, input the loan amount, interest rate, and loan term in cells. For example, let’s say:

Loan amount: $10,000 (cell A1)

Annual interest rate: 5% (cell A2)

Loan term: 5 years (cell A3)

Calculate Monthly Payment: Use the PMT function to calculate the monthly loan payment.