Step 1: Set Up Your Excel Workbook

- Open Excel and create a new workbook.

- Rename the first sheet as “Salary Slip” and the second sheet as “Payroll.”

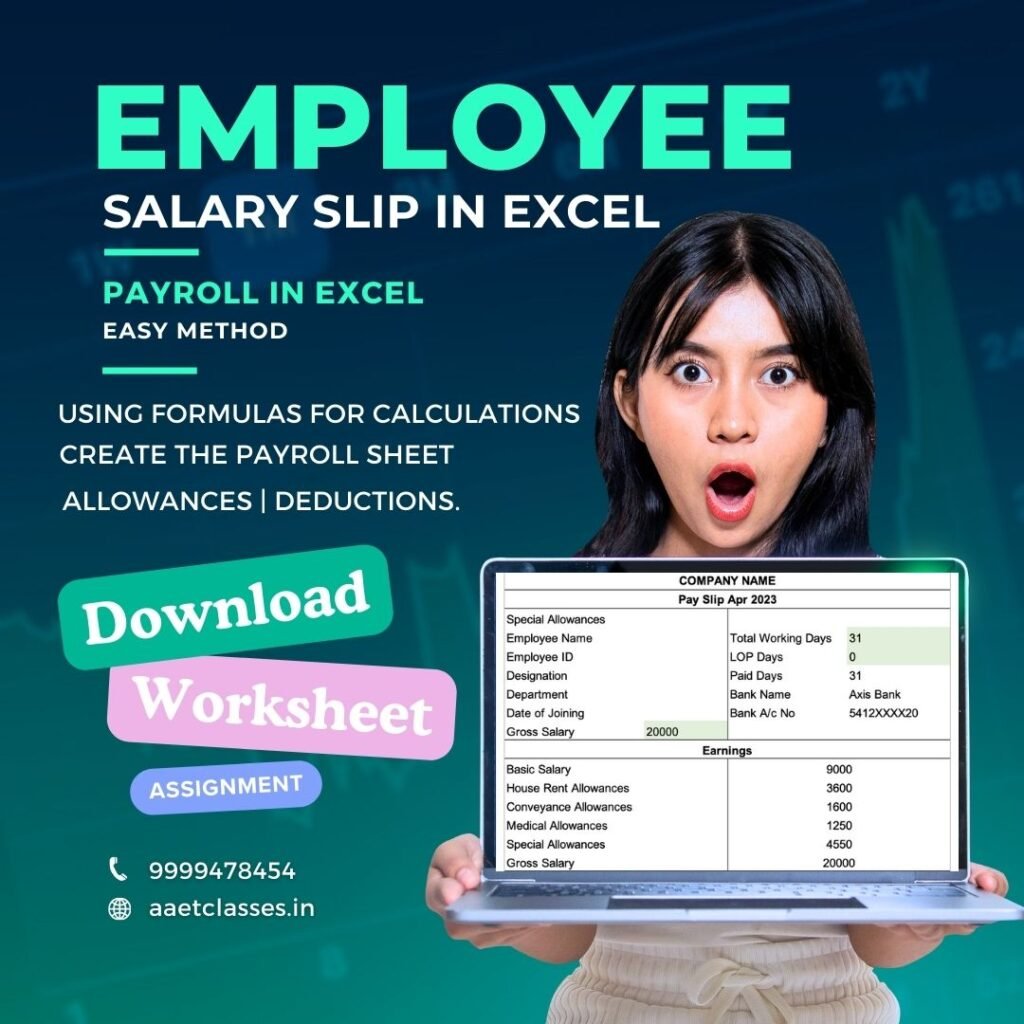

Step 2: Design the Salary Slip

- In the “Salary Slip” sheet, create a table with the following headers: Employee ID, Employee Name, Basic Salary, Allowances, Deductions, Net Salary.

- Enter the relevant employee details under each column. Ensure you leave space for numerical entries like salary amounts, allowances, and deductions.

- Calculate the net salary by subtracting the total deductions from the total earnings (basic salary + allowances).

Step 3: Create the Payroll Sheet

- In the “Payroll” sheet, create a table with columns for Employee ID, Employee Name, Basic Salary, Allowances, Deductions, and Net Salary.

- Enter the details of all employees in this table.

- You can use formulas to calculate the net salary automatically based on the basic salary, allowances, and deductions entered.

Step 4: Using Formulas for Calculations

- In the Net Salary column of both sheets, use Excel formulas to calculate the net salary based on the basic salary, allowances, and deductions.

- For example, the formula for calculating net salary could be: =Basic Salary + Allowances – Deductions.

- Make sure to format the cells appropriately to display currency values.

Step 5: Formatting and Customization

- Format the cells to display currency values, percentages, and other relevant formats.

- You can add additional columns for tax deductions, bonuses, or any other relevant information.

- Customize the appearance of the salary slip and payroll sheets according to your organization’s branding or requirements.

Step 6: Review and Test

- Double-check all formulas to ensure accuracy.

- Test the spreadsheet with sample data to ensure calculations are correct.

Step 7: Save and Distribute

- Save the Excel workbook with an appropriate name.

- When it’s time to distribute the salary slips to employees, you can print them or convert them to PDF format for easy sharing via email or other digital means.

Play Video